Understanding the Formula for Calculating Gross Profit Margin

In the world of business, profitability isn’t just a goal—it’s a necessity for survival. Among the myriad of financial metrics available, one stands out for its fundamental clarity and critical insight: the gross profit margin. This figure is more than just a percentage on a spreadsheet; it is a direct reflection of production efficiency, pricing strategy, and the core health of a company’s primary business activities. For entrepreneurs, managers, and investors alike, mastering the formula for calculating gross profit margin is the first essential step toward making informed strategic decisions. This article will deconstruct this vital metric, explore its components, and demonstrate how to leverage it for sustainable business growth.

What is Gross Profit Margin?

Gross profit margin, often simply called gross margin, is a financial metric expressed as a percentage. It reveals the proportion of money left over from revenues after accounting for the direct costs associated with producing the goods or services sold, known as the Cost of Goods Sold (COGS). Essentially, it answers the question: “How much does each dollar of sales contribute to covering our overhead and generating profit, after paying for the direct costs of production?”

This metric is paramount because it isolates the profitability of a company’s core operational activities. It excludes indirect expenses like administrative salaries, marketing costs, and rent, focusing solely on the relationship between revenue and production cost. A strong gross margin indicates that a company can efficiently produce its product or deliver its service, providing a robust foundation upon which to build net profitability.

The Core Components: Revenue and COGS

Before applying the formula for calculating gross profit margin, it’s crucial to understand its two fundamental inputs.

1. Revenue (or Net Sales)

This is the total income generated from the sale of goods or services before any expenses are deducted. It’s important to use net sales in the calculation, which is gross sales minus any returns, allowances, and discounts. This provides a more accurate picture of the actual revenue retained.

2. Cost of Goods Sold (COGS)

COGS represents all the direct, variable costs attributable to the production of the goods sold by a company. This includes:

-

Direct Materials: Raw materials and components used in creation.

-

Direct Labor: Wages for employees directly involved in production.

-

Manufacturing Overhead: Directly tied production costs like factory utilities, equipment depreciation, and supervisor wages.

Notably, COGS excludes indirect, fixed expenses such as distribution, sales force costs, and executive salaries, which fall under operating expenses.

The Essential Formula for Calculating Gross Profit Margin

The calculation is a two-step process: first, determine gross profit in dollar terms; second, convert it to a margin percentage.

Calculate Gross Profit

Gross Profit = Net Revenue - Cost of Goods Sold (COGS)

Calculate Gross Profit Margin Percentage

Gross Profit Margin = (Gross Profit / Net Revenue) x 100

This final figure is presented as a percentage. For example, a gross profit margin of 35% means that for every dollar of revenue generated, the company retains $0.35 to cover operating expenses, taxes, interest, and net profit.

A Practical Calculation Example

Let’s consider a simplified example for “Bakery XYZ”:

-

Net Revenue (from selling cakes and bread): $500,000 for the year.

-

COGS (flour, sugar, baker wages, oven energy): $325,000 for the year.

Gross Profit = $500,000 – $325,000 = $175,000 Gross Profit Margin = ($175,000 / $500,000) x 100 = 35%

This indicates Bakery XYZ retains 35 cents from each revenue dollar after covering direct production costs.

Why is This Metric a Critical Business Health Indicator?

Tracking your gross profit margin is non-negotiable for sound financial management. Its importance extends far beyond a simple profitability check.

-

Measures Production Efficiency: It directly shows how efficiently you convert raw materials and labor into profit. A declining margin can signal rising supplier costs, production waste, or inefficient labor usage.

-

Benchmarks Pricing Strategy: The margin reflects whether your selling price adequately covers production costs and leaves a healthy contribution. It helps answer if you are pricing too low or can command a higher market price.

-

Enables Comparative Analysis: It allows for “apples-to-apples” comparisons with competitors in your industry, revealing your relative cost structure and operational advantages or weaknesses.

-

Informs Strategic Decisions: Trends in gross margin guide critical decisions on cost negotiation, product line discontinuation, process investment, and potential price adjustments.

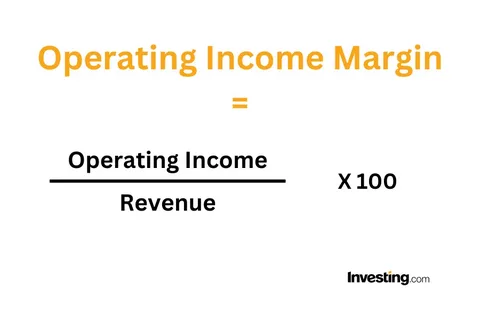

Gross Margin vs. Net Profit Margin: Clarifying the Confusion

A common point of confusion lies in distinguishing gross profit margin from net profit margin. While both are vital, they serve different analytical purposes.

-

Gross Profit Margin: Focuses solely on production efficiency. It considers only Revenue and COGS.

-

Net Profit Margin: Provides the bottom-line profitability. It is calculated as (Net Profit / Revenue) x 100, where Net Profit is what remains after all expenses (COGS, operating expenses, interest, taxes) are deducted from revenue.

A company can have a strong gross margin but a weak or negative net margin if its operating expenses (like marketing, R&D, and admin costs) are excessively high. Analyzing both together tells the full financial story.

Industry-Specific Benchmarks: What is a “Good” Margin?

There is no universal “good” gross profit margin. It varies dramatically by industry due to inherent differences in business models, cost structures, and capital intensity.

-

Service Industries (Consulting, Software): Often have very high margins (60-80%+) as COGS is primarily labor with minimal physical materials.

-

Manufacturing & Retail: Typically have lower margins (20-50%) due to significant material, inventory, and logistics costs.

-

Groceries & Commodities: Operate on famously thin margins (often 10-25%) due to high competition, perishability, and low pricing power.

The key is to benchmark against your direct competitors and your own historical performance to identify positive or negative trends.

Advanced Applications: Analyzing Margin Trends

Seasoned analysts don’t just look at a single point-in-time margin. They analyze trends.

-

Trend Analysis: Tracking margins quarterly or yearly reveals whether efficiency is improving or deteriorating.

-

Segmental Margin Analysis: Applying the formula for calculating gross profit margin to individual product lines, services, or business units can identify which are stars and which are drains on resources.

-

Driver Analysis: A declining margin prompts investigation into its root causes: Are material costs rising? Is labor productivity falling? Has discounting eroded prices?

Common Pitfalls and Mistakes in Calculation

Inaccurate data leads to misleading margins. Common errors include:

-

Misclassifying Expenses: Including indirect costs in COGS inflates the figure and artificially deflates your margin.

-

Using Gross Revenue: Failing to account for returns and discounts overstates revenue.

-

Inconsistent Inventory Accounting: Switches between FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) methods can cause significant COGS fluctuations.

-

Ignoring Overhead Allocation (for manufacturers): Improperly allocating factory overhead to COGS distorts the true production cost.

Strategic Levers: How to Improve Your Gross Profit Margin

If analysis reveals a margin that is low or shrinking, strategic levers exist to address it.

Increase Prices Strategically

This is the most direct lever, but must be handled with market sensitivity. Justifying price increases through enhanced value, branding, or feature improvements can boost margin without sacrificing volume.

Reduce Cost of Goods Sold (COGS)

-

Negotiate with Suppliers: Seek bulk discounts or more favorable payment terms.

-

Optimize Supply Chain: Reduce shipping costs, find local suppliers, or streamline logistics.

-

Improve Operational Efficiency: Invest in technology or training to reduce labor hours and material waste per unit.

-

Reformulate Products: Explore using alternative, cost-effective materials without compromising quality.

Optimize Product Mix

Focus sales and marketing efforts on products or services with inherently higher margins. Consider discontinuing low-margin items that consume disproportionate resources.

The Role of Technology in Margin Management

Modern businesses leverage technology for precise margin tracking. Enterprise Resource Planning (ERP) and inventory management systems automate data collection, providing real-time insights into COGS and allowing for dynamic calculation of gross profit margins by product, channel, or customer. This enables proactive, data-driven decision-making rather than reactive hindsight.

Conclusion

The formula for calculating gross profit margin is a deceptively simple equation with profound implications. It serves as the foundational lens through which to assess the fundamental viability of a business’s core operations. Moving beyond mere calculation to consistent tracking, trend analysis, and strategic action based on its insights separates thriving businesses from struggling ones. By mastering this metric, you gain not just a number, but a powerful tool for diagnosing financial health, guiding pricing, controlling costs, and ultimately, steering your enterprise toward greater and more sustainable profitability. Make its regular analysis a non-negotiable ritual in your financial review process.

Frequently Asked Questions (FAQs)

Q1: Can gross profit margin ever be negative? Yes, a negative gross profit margin occurs when the Cost of Goods Sold (COGS) exceeds net revenue. This is a severe financial warning sign, indicating that the business is losing money on every unit it sells before even covering overhead. Immediate corrective action is required.

Q2: How often should I calculate my gross profit margin? For active management, it’s advisable to calculate it at least monthly. Many businesses with real-time data track it even more frequently. Regular tracking allows for the quick identification of negative trends.

Q3: Is a higher gross profit margin always better? Not universally. While a higher margin generally indicates stronger efficiency, an excessively high margin could also signal that prices are too high, potentially driving away customers and limiting market share. Context and industry benchmarks are essential.

Q4: How does gross margin differ for a service-based business? For service businesses, COGS is primarily the direct labor cost of the individuals delivering the service (e.g., consultants, lawyers, repair technicians), plus any directly attributable costs like software licenses or travel. The formula remains identical.

Q5: Why might my gross margin fluctuate seasonally? Seasonality in costs (e.g., raw material prices), sales volume (affecting bulk purchase discounts), or product mix (selling higher-margin items in certain seasons) can cause legitimate fluctuations. It’s important to compare margins to the same period in previous years.